You worked for so many years to finally earn that elusive right to finally say, “I’m retired”. You just want to sleep in, relax and enjoy that leisurely life that you so deserved. However, you will most likely find something missing in your retirement life. It’s just human nature to explore. For some people, the need for connection to the outside world becomes overwhelming. Then thoughts of perhaps taking on a part-time or even another different full-time job start to creep in.

The reasons are not always about the money

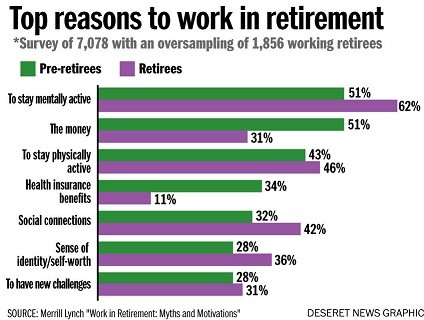

As per the chart, the main reasons retirees prefer to keep working to some degree during their retirement is to stay mentally and physically active. These reasons are followed by maintaining solid social connections and a strong sense of identify or self-worth. Granted some retirees would prefer to keep working full time past that typical retirement age of 65 or 67or whenever government pension benefits kick in. Others might want to balance their work life with some retirement pleasure by only working part-time.

As per the chart, the main reasons retirees prefer to keep working to some degree during their retirement is to stay mentally and physically active. These reasons are followed by maintaining solid social connections and a strong sense of identify or self-worth. Granted some retirees would prefer to keep working full time past that typical retirement age of 65 or 67or whenever government pension benefits kick in. Others might want to balance their work life with some retirement pleasure by only working part-time.

Either way, it’s an opportunity to hopefully do something you love. A chance for a do-over where you can try something you would have, could have or should have done, if only you had the knowledge and wisdom you have accumulated now. Baby boomers have developed a significant number of skills over the years, not to mention, a very good understanding of what can be accomplished over the internet. The question is – what wisdom could you share with the world that would help solve a problem, satisfy a need or provide guidance for a large number of people?

Time to learn new skills

Think about it! If you’re retired or about to be retired, you know there will be hectic times and down times during retirement. Why not challenge yourself mentally during those down times to do some research into an idea that could keep you mentally active and perhaps even earn some extra income down the road. I am not the expert here on this whole subject of starting an online business but I have done the research, I have learned from my son’s online business as well as following a few experts in the field of internet marketing and online business. It’s a very interesting and mentally challenging opportunity for anyone who wants to give it a try. The sense of achievement can be so rewarding. In effect you would be learning a new set of skills while leveraging your own knowledge, experience and wisdom.

Your big idea

Again, given the right mindset to begin the journey of launching an online business, the first thing you need is that big “idea”. You probably have lots of good ideas, even some great ideas but will any of them have a chance at success. Be sure to write down your ideas and research the internet to see what’s out there. Don’t be alarmed if someone else has a similar idea or solution that just means there is a market out there for that idea. One of the experts in the online business world I have been following for over two years now is Pat Flynn from smartpassiveincome.com. One of his blog postings 5-reasons-your-next-big-idea-might-fail addresses the whole idea why some ideas just simply fail and what you should be aware of.

For example, you might have a lot of experience in woodworking, project management or consulting. However, these topics might be too general or involve to large a competitive market where it would be very difficult to successfully launch an online business. However, if you had a lot of experience, for example, in a niche market like teaching interested people on how to play bridge. Then you could offer that experience, with some authority, a series of video tutorials as well as a series of eBooks on various bridge techniques, this could be a better opportunity for success.

Validating your idea

The next step would be to validate that idea by either surveying your friends and family, purchasing some reasonably priced Facebook ads that target a specific market to see if people actually like the idea or perhaps even pre-selling the online course and/or eBook to people online to verify any would be buyers. If you receive any meaningful feedback and results, then you’re onto something. If not, and you pre-sold your product, then you could simply refund the money. It’s so critical to validate your idea before spending an inordinate amount of time developing your product only to see it possibly fail to launch let alone record any sales.

These are guidelines that have been published by the experts in this field. They make sense. This is only the beginning of this journey. Having a winning idea is one thing. Marketing that idea or product is where the real challenge is. For that you need a presence on the internet and that’s where learning those new techniques and skills really begin. The amazing fact is there are several online marketers who offer their wisdom through blog postings, podcast episodes and video tutorials – all for free. I will share with you some of these expert websites. You will be amazed how much information is available. All you need is time to learn. As retirees or soon to be retirees, time is one thing we should have lots of. It’s just a matter of balancing your time between something mentally challenging with your whole retirement lifestyle.

My disclaimer

I will state my disclaimer clearly and simply. The techniques used by these experts were extremely successful for them but it doesn’t mean they will be successful for everyone. Otherwise everyone would be launching online businesses. However, as retirees we do have an additional advantage. We have accumulated years of business knowledge and acumen that we can leverage throughout our retirement years. The key is to find that “idea” for a product or solution that would be of interest to many others. It’s time to start brainstorming ideas. My suggestion would be to seek out a friend, your son, your daughter or your spouse and bounce off ideas to see if any of them stick. Then let the momentum begin.